If you are planning on selling your business in the future, you should be aware of the Lifetime Capital Gains Exemption on the sale of active small businesses.

When you sell a capital asset, such as shares of a company, that is usually taxed as a capital gain. However, when you sell shares of an active business, you may qualify for a tax incentive called the Lifetime Capital Gains Exemption, which allows you to claim almost $900,000 of the capital gain exempt from taxes. That means you can pocket up to $900,000 tax-free (although the alternative minimum tax can apply).

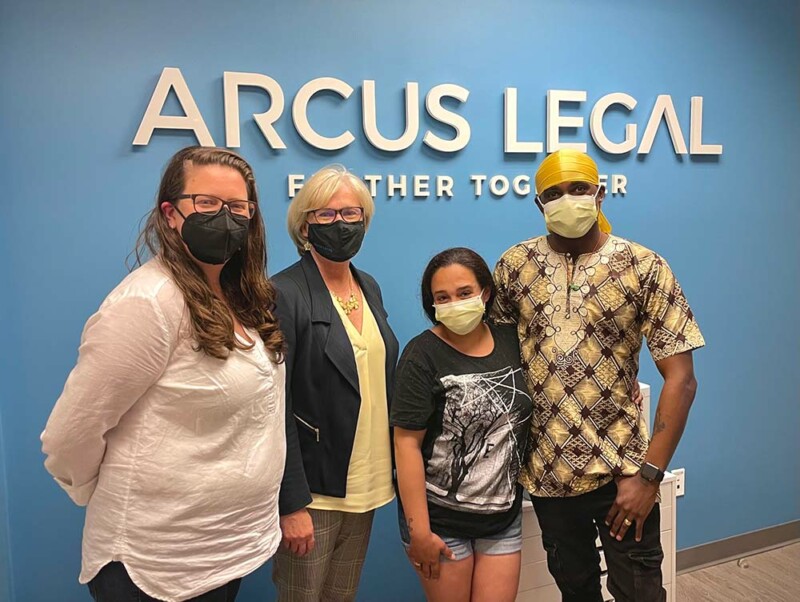

Arcus Legal congratulates the Wiggins family on their new home. Chelcie and Alvero Wiggins (far right) and their four young children were selected by non-profit organization A Home for Everyone to receive donations and support in acquiring a home. Alvero is an active community member in the North End of Halifax, known for his work with Hope Blooms and the LOVE Nova Scotia youth centre. He now lives with kidney disease and spends 9-10 hours a day on dialysis while awaiting a kidney transplant.

Owners of family businesses will gain new tax advantages from a bill that has just passed and is expected to come into effect shortly.

Currently, selling your business to a complete stranger gives you tax benefits that you would lose if you sold to a family member. Bill C-208 extends these benefits to cases where shares in an active business are transferred to a company that is owned by a child, grandchild, or sibling. The sale of shares would now be treated as a capital gain instead of a dividend, meaning you would be taxed at a lower rate and potentially be eligible for the lifetime capital gains tax exemption.… [Read more]

When your business is thriving, and you make more money than needed to cover your personal expenses, this is the time to consider incorporating your business (transferring your business to a company).

From a purely tax perspective, you do not want to be taxed on all your business income in your personal name. You are taxed more than 25% on the income from your business (It gets higher as you fall into higher income brackets), whereas your corporation will only be taxed 12% for the income earned in the corporation. That is a massive difference in dollars available for you to expand your business.… [Read more]