Home » Archives for Arcus Legal » Page 4

Home » Archives for Arcus Legal » Page 4

Our office will be closed tomorrow, Friday, November 11th in honour of Remembrance Day.

We will be back open as normal, Monday, November 14th.

Arcus Legal welcomes its newest member to the team, Barbara Mackie.

Osgoode Hall Law School recently featured Arcus Legal lawyer Johann Du Plessis in an Alumni Spotlight article. Check out the link below to learn more about Johann’s impressive career.

Happy Canada Day from all of us at Arcus Legal 🍁

We will be closed today July 1st, for Canada Day and will be back on Monday, July 4th.

We are pleased to announce that Gregg Knudsen has joined Arcus Legal to practice with our Property and Estates Teams. Bringing more than 30 years of experience to our firm, he will be serving clients’ needs for estate and trust planning, probate administration, and real property transactions. Gregg also offers experience in elder law, charitable giving, wealth management, taxation, business succession, and mental health law. Throughout his career, Gregg has contributed extensively to the legal profession and his local community, sitting on provincial review and appeal boards, chairing Canadian Bar Association sections, and serving on law reform initiatives.

To learn more about Gregg and the services he offers his clients, see our website at: https://www.arcuslegal.ca/gregg-knudsen.… [Read more]

Today, on Administrative Professionals Day, we recognize and celebrate the work of those who have a big impact in the workplace, those who make our offices more efficient and productive every single day.

Administrative Professionals at all levels are recognized for their hard work, making sure everything can run smoothly throughout an entire company while supporting its staff in any way they can.

It’s because of all their hard work, we can all go #FurtherTogether.

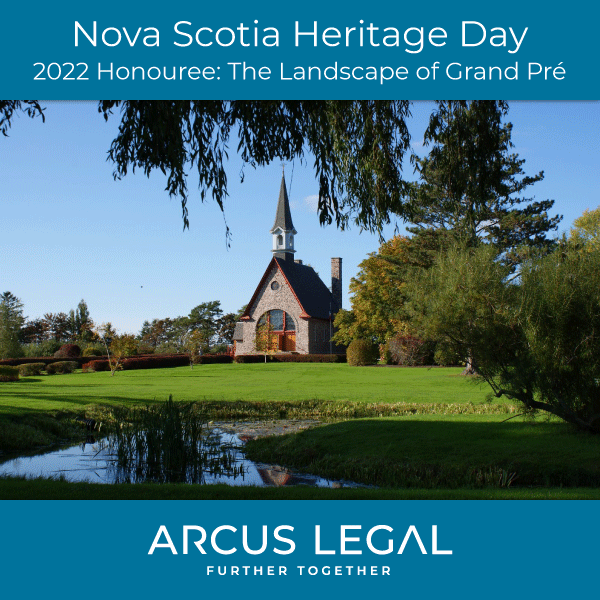

Arcus Legal will be closed on Monday, February 21 for Nova Scotia Heritage Day. The Landscape of Grand Pré has been selected as the 2022 Nova Scotia Heritage Day honouree, celebrating the rich heritage of this iconic place of memory for the Acadian diaspora. This year marks the 10th anniversary of the Landscape of Grand Pré becoming a UNESCO World Heritage Site.

(Photo credit: valleytourism.ca)